The Indian government has announced major revisions to income tax slabs on behalf of the Financial Year 2025-26. The current proposals for the new tax regime align with tax relief and are highly beneficial, especially for middle-class taxpayers.

The biggest highlight?

A full rebate for incomes up to ₹12 lakh (new tax regime) ensures zero tax liability for a large population segment. This marks a significant jump from the previous ₹7 lakh limit, allowing middle-class earners to retain more of their hard-earned income.

Whether you're a salaried employee or a senior citizen, these changes are designed to ease financial pressures and boost overall economic growth. Let's dive into the details of these changes and explore how they can impact you!

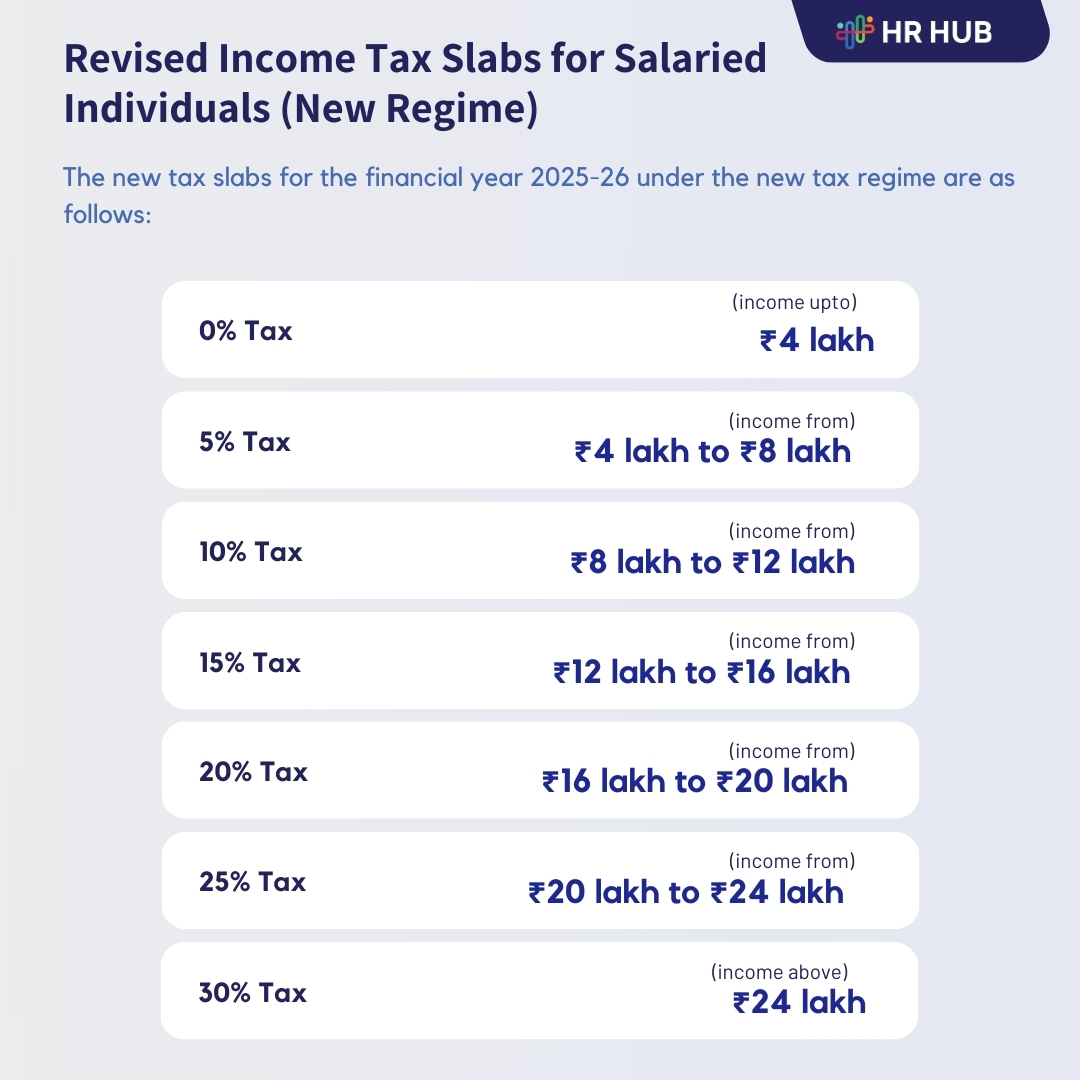

Revised Income Tax Slabs for Salaried Individuals (New Regime)

The new tax slabs for the financial year 2025-26 under the new tax regime are as follows:

Example Calculation: Tax Payable on an Income of ₹12.75 Lakh

Tax Calculation for an Employee Earning ₹12.75 Lakh

Assumptions:

- Gross Salary: ₹12.75 lakh

- Standard Deduction: ₹75,000

- Taxable Salary: ₹12.75 lakh - ₹75,000 = ₹12 lakh

Now, let's break down the tax calculation based on the new tax regime for ₹12 lakh taxable income:

Tax Slabs:

- 0 to ₹4,00,000 – No tax

- ₹4,00,001 to ₹8,00,000 – 5%

- ₹8,00,001 to ₹12,00,000 – 10%

Let’s see the step-by-step tax calculation:

- Income from ₹0 to ₹4,00,000 – No tax (₹4,00,000)

- Income from ₹4,00,001 to ₹8,00,000 – 5% tax on ₹4,00,000

- Tax: ₹4,00,000 × 5% = ₹20,000

- Income from ₹8,00,001 to ₹12,00,000 – 10% tax on ₹4,00,000

- Tax: ₹4,00,000 × 10% = ₹40,000

Total Tax Before Rebate:

₹20,000 + ₹40,000 = ₹60,000

Rebate Under Section 87A:

Since the taxable income is ₹12 lakh (below ₹12.75 lakh), the employee qualifies for the Section 87A rebate. This fully waives the tax liability for employees with taxable income up to ₹12 lakh.

Rebate Amount = ₹60,000 (entire tax liability)

Final Tax Liability:

After applying the rebate, the total tax liability is ₹0.

Marginal Relief for Salaries Just Above ₹12.75 Lakh

Another Scenario: Employee Earning ₹12.80 Lakh

Assumptions:

- Gross Salary: ₹12.80 lakh

- Standard Deduction: ₹75,000

- Taxable Salary: ₹12.80 lakh - ₹75,000 = ₹12.05 lakh

Tax Slabs for ₹12.05 Lakh:

- 0 to ₹4,00,000 – No tax

- ₹4,00,001 to ₹8,00,000 – 5% tax on ₹4,00,000 = ₹20,000

- ₹8,00,001 to ₹12,00,000 – 10% tax on ₹4,00,000 = ₹40,000

- Total Tax Before Marginal Relief: ₹20,000 + ₹40,000 = ₹60,000

Section 87A Rebate:

Since the taxable income is below ₹12 lakh, the employee is eligible for a full rebate of ₹60,000 under Section 87A, which zeroes out the tax.

Let’s look at the Marginal Relief for an employee earning just ₹12.80 lakh, which is ₹5,000 above ₹12.75 lakh.

How Marginal Relief Works:

- Excess Income Over ₹12.75 Lakh = ₹12.80 Lakh - ₹12.75 Lakh = ₹5,000

- Calculated Tax Before Relief = ₹60,000

- Tax Payable Without Relief = ₹60,000 (calculated as per slabs)

Now, to apply Marginal Relief, the employee will pay tax based on the excess income over ₹12.75 lakh:

Marginal Relief Calculation:

- Excess Income: ₹5,000

- Tax Payable After Marginal Relief: The tax will be capped at the excess income of ₹5,000, meaning the employee will only need to pay ₹5,000 in tax.

- Final Tax Liability: ₹5,000 (instead of ₹60,000)

Benefits of the New Tax Slabs Under the New Regime

Let’s understand what individuals will benefit from the new tax regime.

- Zero Tax for Lower Income Groups: With the income exemption limit raised to ₹12 lakh, many middle-class individuals will now enjoy zero tax liability, significantly increasing their disposable income.

- Simplified Tax Filing: The clear and progressive slab system makes tax calculation straightforward, reducing the complexity of tax filing and making it easier for individuals to understand their obligations.

- Benefits for Salaried Individuals: Individuals with gross salaries up to ₹12.75 lakh can claim a full rebate under Section 87A, ensuring they pay no tax due to the standard deduction of ₹75,000.

- Encouragement for Savings and Investments: The increase in disposable income encourages individuals to save and invest more, promoting financial security and long-term wealth building.

- Marginal Relief for Higher Incomes: The introduction of Marginal Relief ensures that individuals earning just above ₹12.75 lakh don't face a sudden tax jump, making the transition to higher tax brackets smoother.

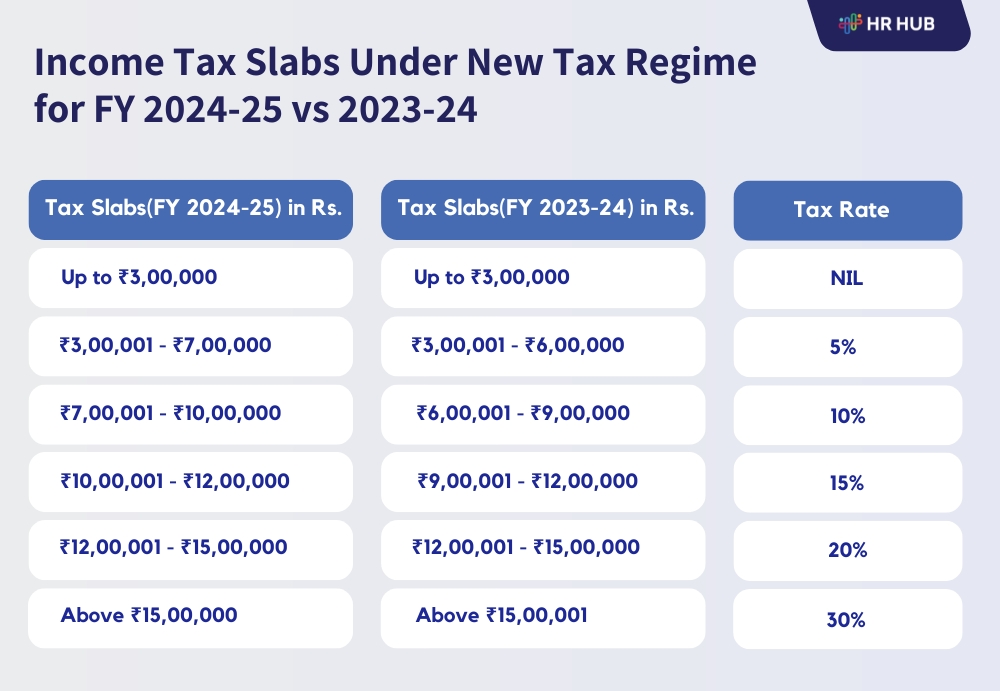

Let’s see the situation of introducing the New Tax Regime as compared to the old regime in the following table:

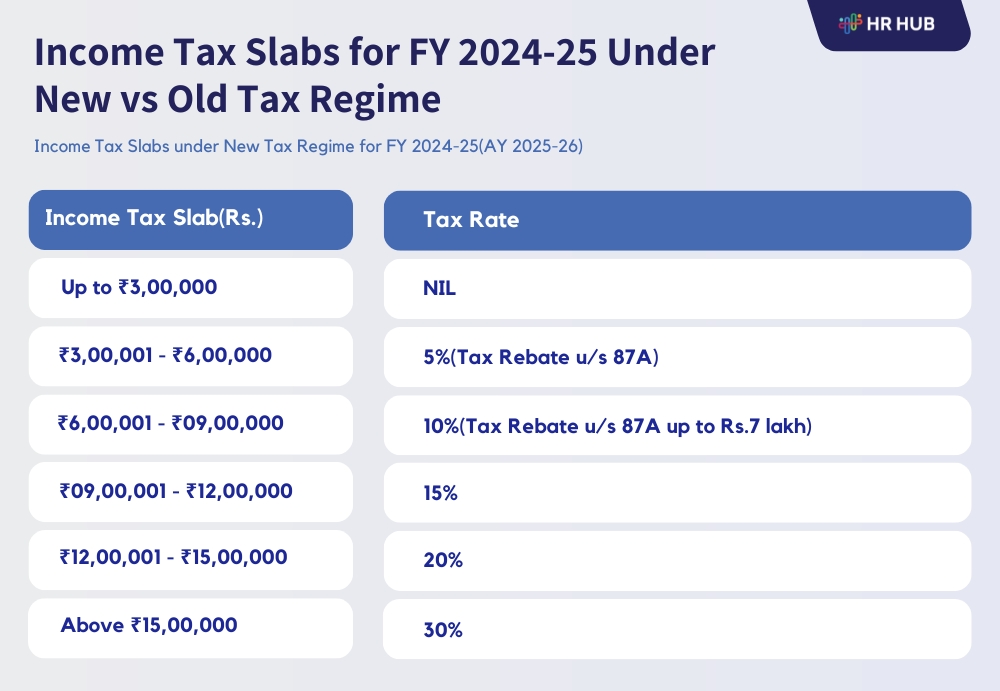

So, now let’s see the income tax slabs under the new tax regime for FY 2024-25 (AY 2025-26)

Old vs. New Tax Regime: Which One Should You Choose?

Choosing between the old and new tax regimes depends on individual financial circumstances. So, it’s better to compare the value from the new to the old tax regime (Indian Budget 2024).

Final Thoughts

The new income tax regime for FY 2025-26 comes with lower tax rates and higher tax-free income limits, offering substantial relief to middle-class taxpayers. However, it does not offer any deductions and exemptions, so it might not be the best option for everyone.

Therefore, assess your income, tax-saving investments, and financial goals before deciding which tax regime works best for you - the old or the new.

Stay informed, well-planned for, and optimized in savings, all the while!