“In HR, compliance is no longer just policy — it’s culture, accountability, and foresight woven together.”

Suppose you’re still treating compliance as an end-of-quarter checklist. Welcome to 2025, where the regulatory landscape has evolved into a dynamic, real-time terrain. With new HR compliance guidelines emerging and older ones being reinterpreted, HR professionals — especially in India — are now expected to be part legal expert, part culture champion.

Let’s be honest: Indian companies aren’t just managing people anymore. They’re managing laws, risks, sentiments, and standards — all at once. And ignoring this evolution? That’s the fastest path to penalties, attrition, and reputational damage.

This blog isn’t about preaching policies — it’s about decoding the real story behind compliance. Let’s get into it.

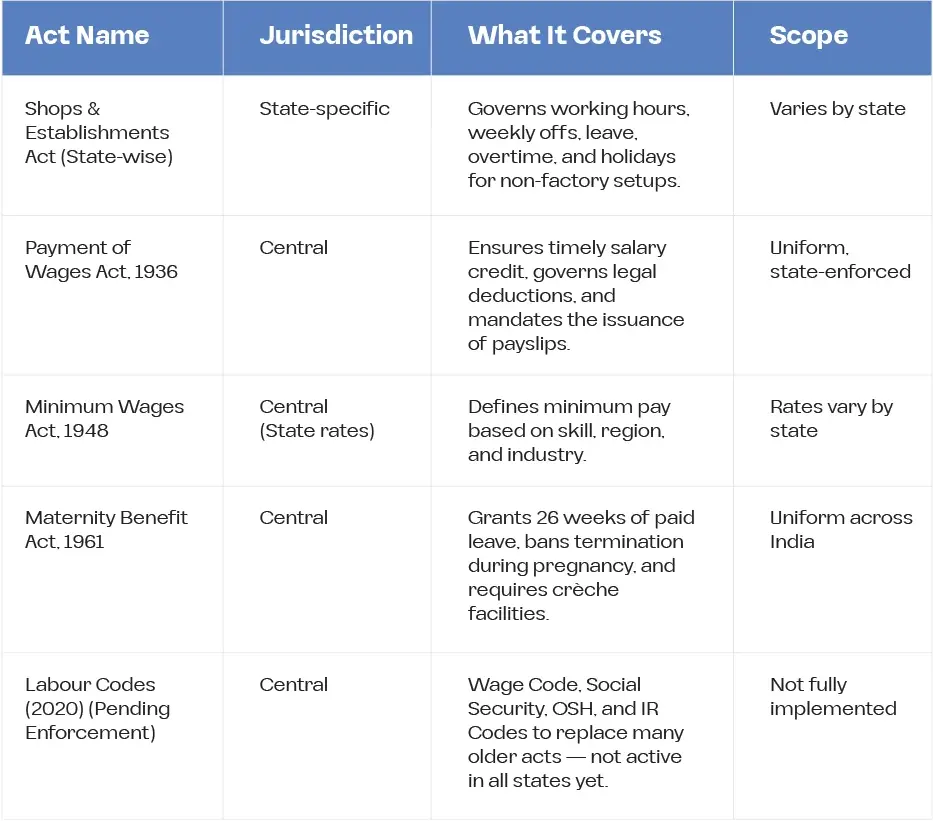

Key Labour Laws Every Indian HR Must Know

While the Labour Codes are set to consolidate and replace several laws, until they are fully enforced, HR leaders must still follow these cornerstone regulations:

1. Shops & Establishments Act (State-wise)

What It Is:

The Shops and Establishments Act is a state-specific legislation that regulates the working conditions and employment practices in shops, commercial establishments, offices, hotels, theatres, and other places of public entertainment.

Key Provisions:

- Working hours and daily/weekly limits

- Opening and closing hours

- Weekly offs and rest intervals.

- Leave policies (Casual, Sick, Earned Leave)

- Public holidays and festival leave

- Wage payment during leave and holidays

- Employment of women and young persons

- Maintenance of registers and display of notices

State-Level Variations:

Each Indian state has its version of this Act. For example:

- Delhi allows up to 9 hours per day and 48 hours per week, with specific holiday rules in place.

- Maharashtra mandates holidays on January 26th and May 1st, with paid leave accrual rules.

- Tamil Nadu has distinct registers and inspection protocols in place.

HR Compliance Note:

If your company operates in multiple states, you must tailor your leave structure, holiday list, and working hours policy to each location to remain compliant.

2. Payment of Wages Act, 1936

What It Is:

This Central Act ensures that employees receive their wages on time and without unauthorized deductions.

Key Provisions:

- Salary must be paid before the 7th/10th of each month (depending on the employee count)

- Only legal deductions are permitted (PF, tax, fines, etc.)

- Payslips must reflect gross pay, deductions, and net pay.

- No unauthorized delay or withholding of wages

Who It Applies To:

Initially intended for employees earning up to ₹24,000 per month, but now widely considered applicable to all employees under state rules.

HR Compliance Note:

HR must ensure that payroll systems are configured to trigger salary payments within the defined window, with transparent breakdowns of deductions and allowances.

3. Minimum Wages Act, 1948

What It Is:

This central law mandates minimum wage rates that must be paid to workers across various occupations and skill levels.

Key Provisions:

- Wage rates notified by each state, based on:

- Skill level: unskilled, semi-skilled, skilled, highly skilled

- Nature of work (e.g., construction vs IT support)

- Location (urban vs rural)

- Wages include: Basic + DA (Dearness Allowance)

- Revised periodically (every 6 months in most states)

Example:

- As of 2024, the monthly minimum wage for skilled workers in Delhi is over ₹20,000.

- In Bihar, the Same skilled worker wage may be around ₹12,000.

HR Compliance Note:

Employers must review state notifications regularly. Failing to meet the minimum wage can result in fines, back pay orders, and potential criminal liability.

4. Maternity Benefit Act, 1961

What It Is:

This Central legislation ensures the welfare and job security of pregnant women employees in the organized sector.

Key Provisions:

- 26 weeks of paid maternity leave (for the first 2 children)

- 12 weeks for the third child and beyond

- No termination during maternity leave or the pregnancy period

- Work from home after leave (if role allows)

- Mandatory crèche facility for emtoyers with 50+ emplremains

- No assignment of arduous tasks or night shifts during pregnancy

HR Compliance Note:

Policies and offer letters must clearly reflect maternity provisions. Termination or negative appraisal during pregnancy can lead to serious legal action and reputational damage.

However, there are some laws that Indian HR leaders cannot ignore in their day-to-day operations.

Weekly Working Hours and Overtime

The new law allows for flexibility — employees can work 4-day weeks (12-hour days) instead of 6-day weeks — but only with consent.

Overstepping this can invite lawsuits under the Factories Act or the Shops and Establishments Act.

Further, overtime pay must be:

- 2x the regular wage.

- Documented and consent-based.

- Reflected in payslips — else it’s treated as wage suppression.

Leaves, Holidays, and Breaks

Don’t confuse compliance with culture. Just giving 12 CLS and 12 PLs isn't enough if:

- You don’t factor in state-specific leave entitlements.

- You skip National Holidays, which are mandatory under each state's Act.

- You lack an explicit leave encashment policy, which employees can contest in the labor court.

A pro tip? Establish a leave compliance matrix for each location to ensure adherence to leave policies. HR HUB offers this feature, making it easier to automate alerts and policy adjustments.

Contractual vs. Permanent Employment

The Supreme Court of India has ruled multiple times that repeated extensions of fixed-term contracts are considered to be permanent employment. So:

- If your project-based workers have been working for 2 years or more, reassess their contracts.

- Add gratuity, bonus, and leave provisions to avoid wrongful termination suits.

Workplace Policies: Draft, Distribute, Digitize

Here’s where most Indian companies fall short. They’ve brilliant hiring strategies and strong payroll systems, but outdated and disconnected workplace policies.

Common problems:

- Policies drafted in 2018 are still being handed out in 2025.

- PDFs are being emailed with no digital acknowledgement.

- Employees have no clue where to find the policy repository.

Here’s how to fix it:

- Utilise HR Tech to implement and track policies, such as HR HUB’s policy acknowledgement tool.

- Ensure policies reflect new laws—for example, policies regarding gig workers and pension fund (PF) contributions must be updated after the Social Security Code is enacted.

- Maintain multilingual access—For pan-Indian companies, ensure policies are translated into at least Hindi, Tamil, or local languages based on region.

- Attach training modules – A POSH policy without a training tracker isn’t complete compliance.

Also, remember that policy updates must be timestamped. If a case goes to court, you must prove that the policy existed and was accepted by the employee before the incident occurred.

From Compliance Chaos to Confidence

Let’s be real — navigating HR compliance in 2025 isn’t about ticking off legal checklists. It’s about building a workplace that’s transparent, proactive, and resilient — where policies aren’t just documents but living systems.

Whether it’s aligning with India's new labor codes, managing remote teams across time zones, or simply keeping every employee informed and acknowledged, the gap between knowing and doing is where companies win or lose.

And that’s exactly where HR HUB steps in — transforming your compliance efforts from fragmented to frictionless. With tools for policy distribution, digital acknowledgements, audit-ready records, and multi-location localization, HR HUB doesn’t just help you comply — it helps you lead with clarity and confidence.

Because in the world of HR, when compliance becomes culture, everybody wins.