Maternity and Paternity Leave in India: Policy, Importance, and Benefits

- Work Culture & Experience

This site uses cookies to deliver our services. By using our site, you acknowledge that you have read and understand our Cookie Policy. Your use of HR HUB's services is subject to these policies.

Finance Minister Nirmala Sitharaman introduced the Indian Budget 2024, which includes a number of notable adjustments meant to reduce the tax burden on salaried workers. The Indian government has made some changes in the new tax regimes, but there has been no change in the old tax regime.

HR HUB, a leading HR management solution, aims to keep businesses informed about the most recent advancements in payroll, compliance, and human resources. This is a brief rundown of the changes that will help employees and HR departments.

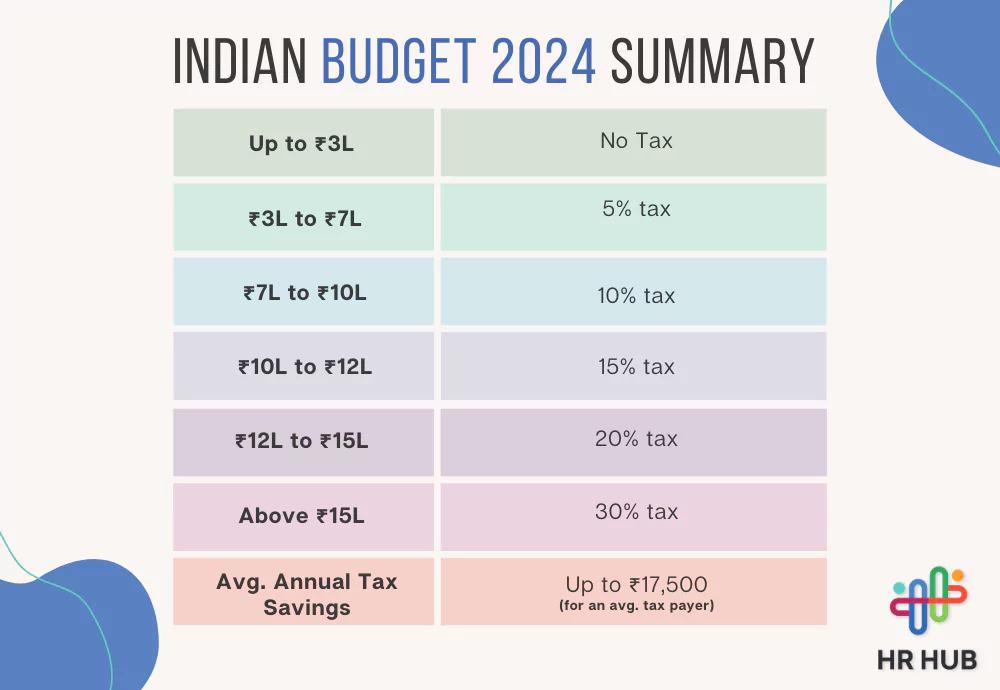

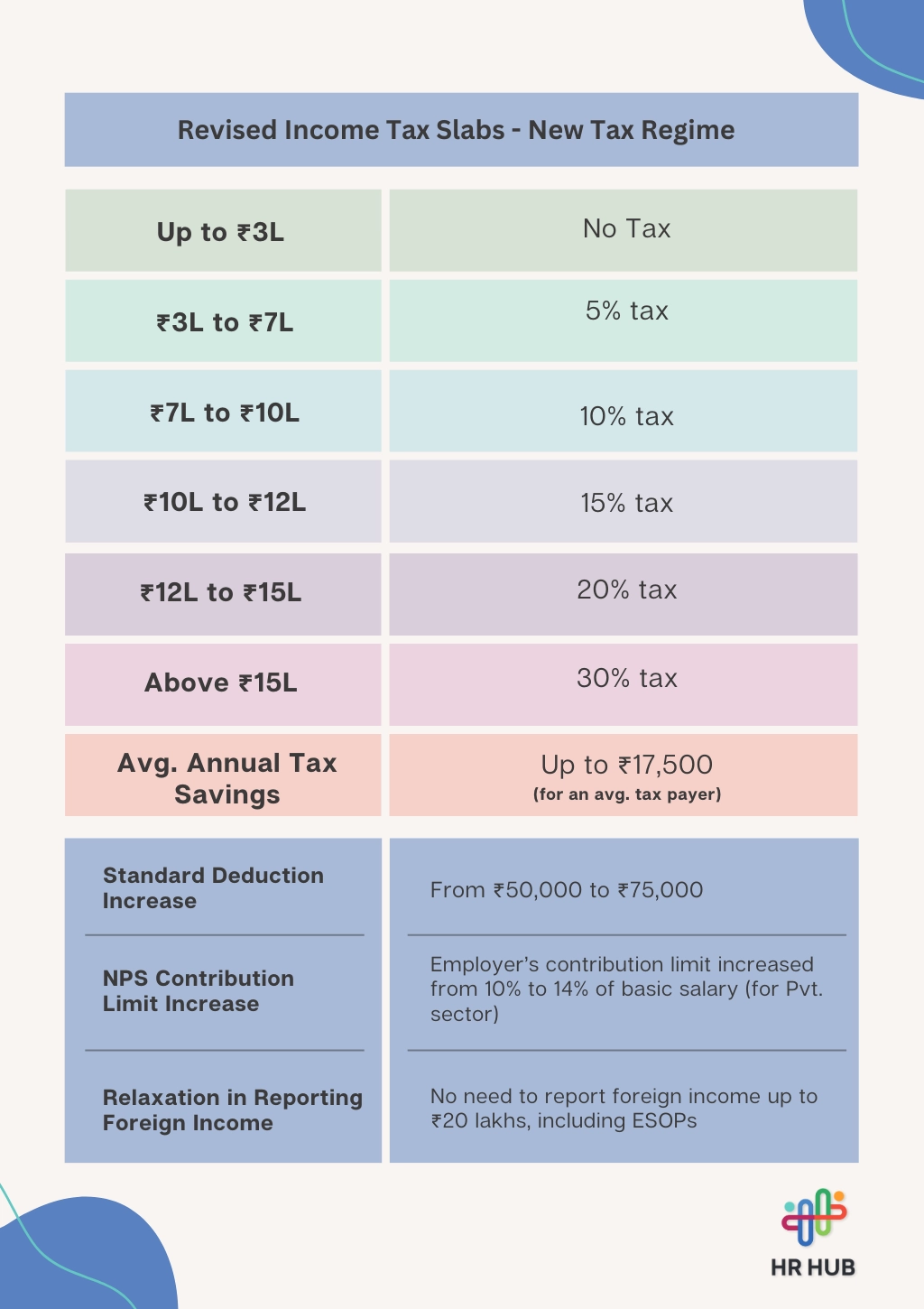

The new regime's updated income tax slabs are intended to provide middle-class taxpayers with more relief:

The typical taxpayer's annual discretionary income rises by up to ₹17,500 as a result of these improvements. Furthermore, salaried taxpayers benefit from an increase in the standard deduction from ₹50,000 to ₹75,000 under the new tax structure. Under the previous government, there was no change to the tax rates.

The budget increased the ceiling on private sector employers' National Pension System (NPS) contributions from 10% to 14% of the employee's basic income. This measure aims to raise retirement savings and align benefits from the private sector with those of central government employees.

The budget eases the requirement for foreign income reports up to ₹20 lakh, which includes earnings from Employee Stock Ownerships Plans (ESOPs) for staff members of international corporations. This modification lessens the administrative load involved in reporting these profits and makes compliance easier for those with minor overseas incomes.

In conclusion, the Indian Budget 2024 proposes changes to streamline tax compliance and give salaried workers financial relief. Some of the major modifications are a simpler tax system with greater standard deductions, higher NPS contribution caps for workers in the private sector, and loosened foreign income reporting rules.

Use an income tax calculator to quickly evaluate how these changes can affect your budget. These changes represent the government's attempts to improve the system's tax-payer friendliness and encourage growth and stability in the financial industry.

Follow HR HUB for further information on payroll, compliance, and HR updates.